The Indian Rupee (INR) faces intense selling pressure against the US Dollar (USD) in afternoon trading hours in India on Thursday. The USD/INR pair posts a fresh all-time high around 90.80 as the Indian Rupee slumps amid uncertainty surrounding trade talks between the United States (US) and India.

Investors remain cautious about whether the US and India will reach a consensus after the two-day meeting, which started on Wednesday, following the arrival of Deputy US Trade Representative Rick Switzer.

On Wednesday, US Trade Representative Jamieson Greer called India a “tough nut to crack” while testifying before the Senate Appropriations Committee, but added that the latest offer by New Delhi is the “best ever” the US has seen, India Today reported.

Meanwhile, the Global Trade Research Initiative (GTRI) has stated in a note that India must insist on balanced outcomes in the ongoing trade negotiations with the US and remain extremely cautious about extending concessions on agricultural crops or genetically modified (GMO) products, ANI reported. The agency added that Washington should first cut tariffs on Indian exports to 25% from 50% if it is serious about the deal.

Meanwhile, a report from Reuters showed that the “Reserve Bank of India (RBI) likely selling US Dollars to help the Indian Rupee avert a sharp fall”.

Trade frictions between the US and India have dampened the interest of overseas investors in the Indian equity market. Foreign Institutional Investors (FIIs) have remained net sellers on all trading days of December, and have offloaded stake worth Rs. 16,470.35 crore.

On the domestic front, investors await the retail Consumer Price Index (CPI) data for November, which will be released on Friday.

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the weakest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | INR | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | 0.13% | 0.06% | 0.16% | 0.69% | 0.55% | -0.07% | |

| EUR | -0.05% | 0.08% | 0.02% | 0.11% | 0.64% | 0.49% | -0.12% | |

| GBP | -0.13% | -0.08% | -0.04% | 0.04% | 0.56% | 0.41% | -0.20% | |

| JPY | -0.06% | -0.02% | 0.04% | 0.10% | 0.62% | 0.47% | -0.13% | |

| CAD | -0.16% | -0.11% | -0.04% | -0.10% | 0.53% | 0.39% | -0.23% | |

| AUD | -0.69% | -0.64% | -0.56% | -0.62% | -0.53% | -0.15% | -0.75% | |

| INR | -0.55% | -0.49% | -0.41% | -0.47% | -0.39% | 0.15% | -0.58% | |

| CHF | 0.07% | 0.12% | 0.20% | 0.13% | 0.23% | 0.75% | 0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Fed’s dot plot shows Federal Fund Rate falling to 3.4% by 2026

- The Indian Rupee trades sharply lower against the US Dollar even as the latter underperforms, following the monetary policy announcement by the Federal Reserve (Fed) on Wednesday. As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, strives to regain ground after refreshing a seven-week low at open around 98.50.

- On Wednesday, the Fed lowered interest rates by 25 basis points (bps) to 3.50%-3.75%. The Fed was widely expected to do so as US labour market conditions have remained weak for almost a year.

- The Fed’s dot plot showed that policymakers see only one interest rate cut in 2026, and Chairman Jerome Powell expressed that the “bar for further monetary easing is very high and we [The Fed] are well-positioned to wait to see how the economy evolves”.

- While market participants had already priced in a 25-bps interest rate reduction, and Fed’s Powell has not explicitly endorsed further rate cuts, the major factor that led to a sharp decline in the US Dollar appears to be comments from Powell pointing to cooling inflation expectations.

- “Evidence is growing that services inflation has come down, and goods inflation is entirely due to tariffs,” Powell said and added, “If there are no new tariff announcements, inflation from goods should peak in Q1.” Before the policy announcement, investors had anticipated that the Fed would announce a pause on further interest rate cuts as inflationary pressures have remained well above the 2% target.

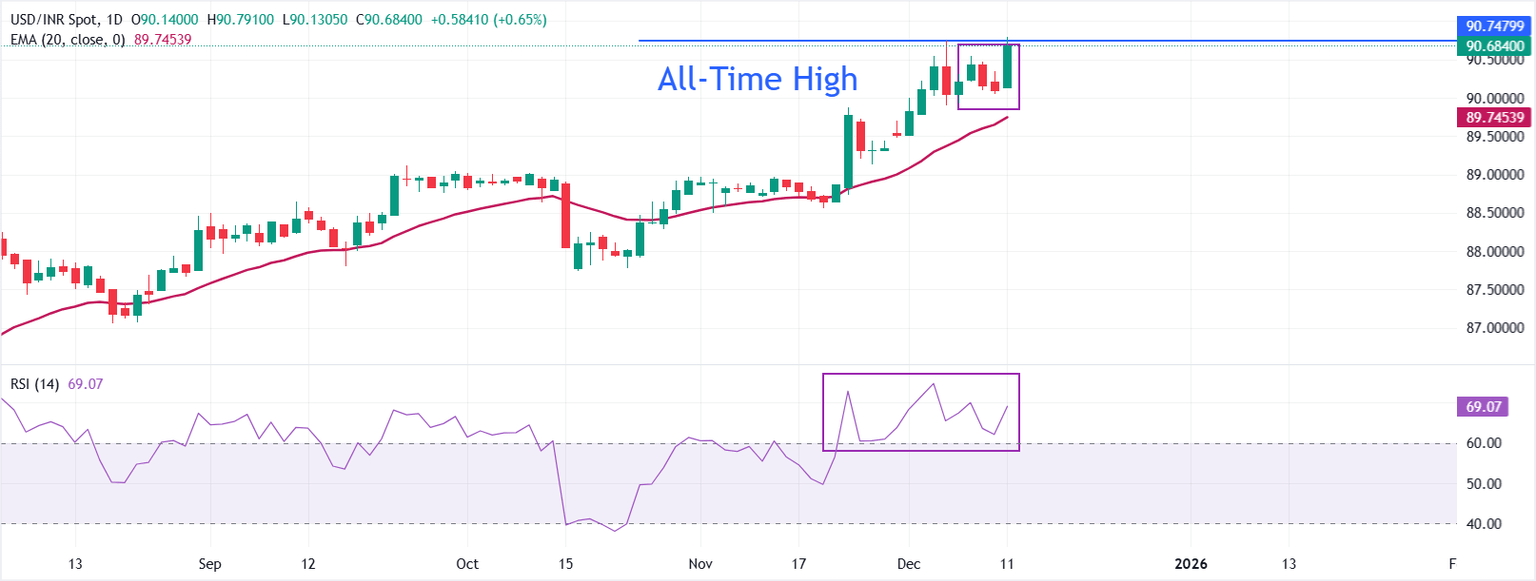

Technical Analysis: USD/INR revisits all-time high near 90.70

USD/INR trades 0.65% higher near 90.80 on Thursday. The pair holds above a rising 20-day Exponential Moving Average (EMA) at 89.74, keeping the short-term trend pointed higher. The 20-day EMA has steepened in recent sessions, reinforcing trend support.

The 14-day Relative Strength Index (RSI) stands at 69.09, turns up after a pullback, confirming bullish momentum.

Momentum would stay constructive while price action remains north of the rising 20-day EMA. A sustained close above that dynamic support would keep dips shallow and could extend the advance towards 92.00, whereas a break back below it would soften the bullish tone and open the downside towards the December 1 low at 89.51.

(The technical analysis of this story was written with the help of an AI tool)

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.