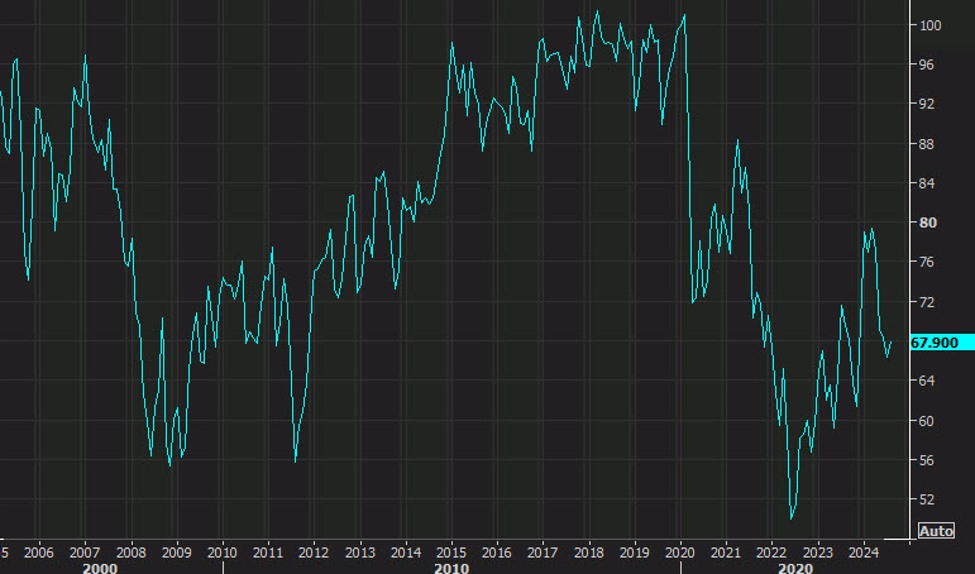

- Prelim was 67.8

- Prior was 66.4

- Current conditions 61.3 vs 60.9 prelim (62.7 prior)

- Expectations 72.1 vs 72.1 prelim (68.8 prior)

- 1-year inflation 2.8% vs 2.9% prelim

- 5-year inflation 3.0% vs 3.0% prelim

Comments from survey director Joanne Hsu:

Consumer sentiment confirmed its early-month reading; after

drifting down for four months, sentiment inched up 1.5 index points

above July and is currently 36% above the all-time historic low from

June 2022. Consumers’ short- and long-run economic outlook improved,

with both figures reaching their most favorable levels since April 2024

and a particularly sizable 10% improvement for long-run expectations

that was seen across age and income groups. Sentiment this month

reflects a slight rise in sentiment among Independents, as Democrats and

Republicans offset each other almost perfectly. Democrats exhibited a

large 10% increase in sentiment while Republicans posted an equally

sized decline. These patterns resulted from a sea change in election

expectations this month with Harris emerging as the Democratic candidate

for president. In July, 51% of consumers expected Trump to win the

election versus 37% for Biden. In August, election expectations flipped;

36% expected Trump to win compared with 54% for Harris. Economic and

election expectations are both subject to change as election day

approaches.

Given the Fed’s focus on employment, here is an interesting chart showing the expected change in unemployment. It ticked up but it still within the recent range.

This article was written by Adam Button at www.forexlive.com.