Micron Technology, Inc. (MU) designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho.

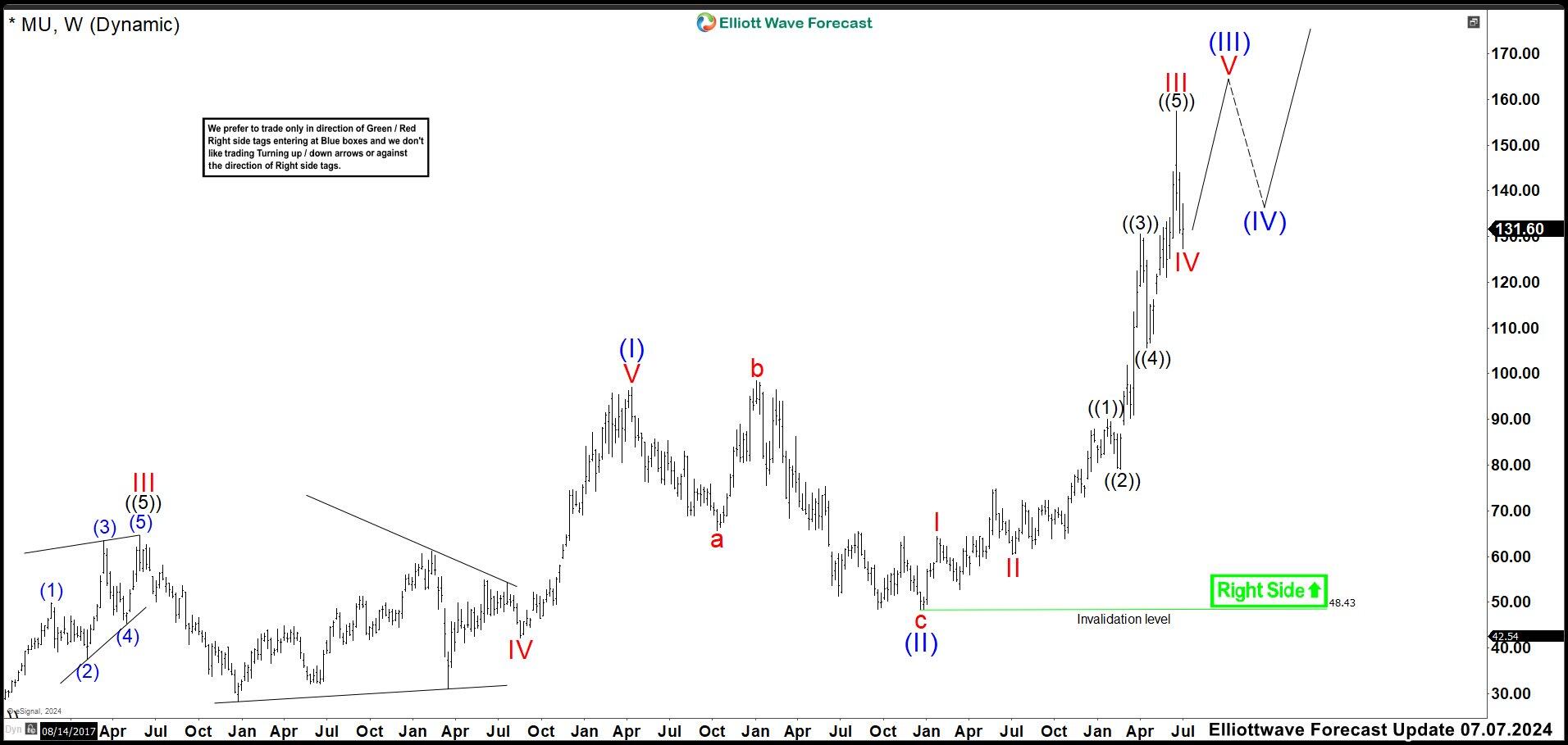

MU weekly chart March 2023

As we see in the chart above, we ended an impulse as wave I at $96.96 high. Then, the market did an expanded flat correction (3-3-5) causing the price to drop to $48.43. We labelled this low as wave II. From here, we expected to continue the rally as long as the price stays above wave II. (If you want to learn more about flat corrections, please follow these links: Elliott Wave Education and Elliott Wave Theory).

MU weekly chart July 2024

In July, we adjusted the labels by calling (I) and (II) where waves I and II were on the chart a year ago. As you could see, MU hit the bottom and started a new bullish cycle breaking above $150.00. This generated a return of more than 200% of the capital. We called a wave III of (III) at $157.54 high and wave IV ended at $127.27 low. We expected to trade higher in wave V of (III) to reach the ideal zone of $164.83 – $176.47 where we should see a market reaction.

MU weekly chart October 2024

This is the latest update of Micron. Wave IV failed to withstand the market onslaught and broke below $127.27. This ended the cycle that started in December 2022 and we adjusted the movement as wave I of (III) ended at $157.57 high. MU did a bearish impulse ending at $84.12 low and we called it wave ((A)) of II. Currently, it is trading in the corrective wave ((B)). Wave (A) ended at $106.75 high. The correction ended wave (B) at $98.94 low. Now wave (C) has already started a new rally and we expect to reach the $130.03 – $149.15 area to culminate wave ((B)) and turn lower in ((C)). The idea is valid as long as the market stays below $157.57 or above $48.43. If the market breaks above wave I, then wave II is most likely over.