December Manufacturing PMI drops from November and comes in not as strong as expected at 50.1

- expected

50.3, prior 50.3 - more positively manufacturing now in expansion for three months

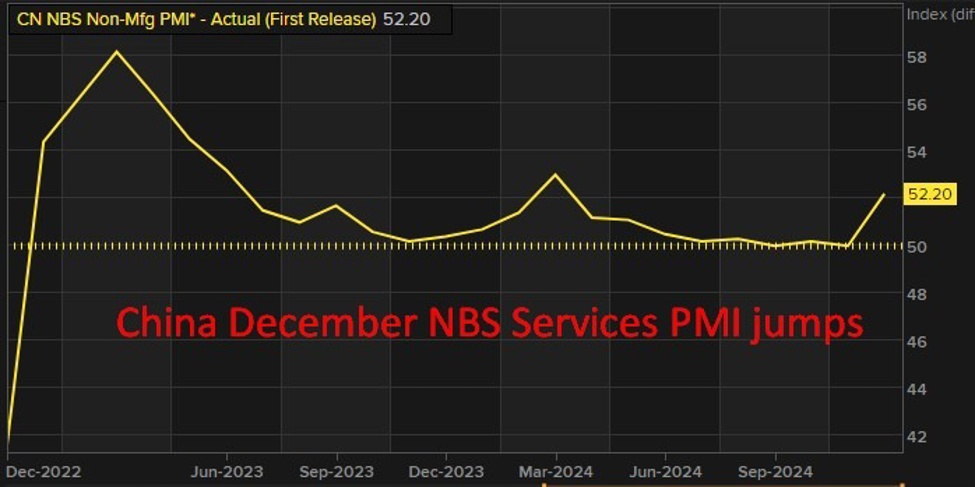

Non-Manufacturing PMI more than makes up for it, jumping well over November and the median estimate to 52.2

- expected 50.2, prior 50.0

Composite 52.2

***

I posted earlier the background to these December results, over the course of H2 of 2024.

ICYMI:

In H2 of 2024 manufacturing has improved, slowly, while services have held in expansion.

Manufacturing PMI:

- July 2024: 49.4, indicating contraction in manufacturing activity. Production expanded slightly (50.1), but new orders fell (49.3).

- August 2024: Remained at 49.4, continuing contraction as challenges persisted in the sector.

- September 2024: Rose to 49.8, showing a slower pace of contraction. Output grew the most in five months.

- October 2024: Increased to 50.1, crossing into expansion territory for the first time in six months, reflecting initial impacts of fiscal stimulus.

- November 2024: Improved further to 50.3, showing modest expansion with strengthening domestic demand.

Non-Manufacturing (Services) PMI:

- July 2024: 51.5, indicating expansion in services, though at a slower pace.

- August 2024: Declined to 51.0, still expanding but with reduced momentum.

- September 2024: Decreased to 50.0, marking stagnation in the sector.

- October 2024: Edged up slightly to 50.2, suggesting mild recovery.

- November 2024: Held steady at 50.0, showing stable but subdued performance.